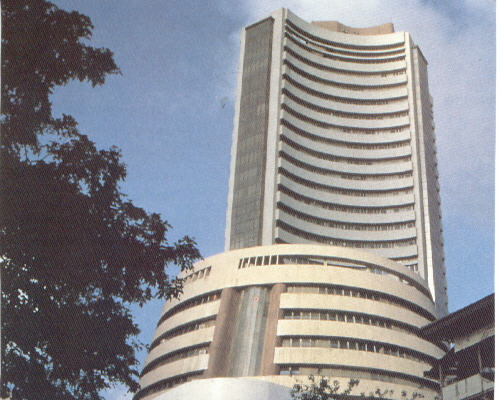

BSE closes 3.3 per cent down

Mumbai, June 9 : Bombay Stock Exchange (BSE) fell 3.3 per cent on Monday led lower by Reliance Industries Limited and Infosys Technologies Limited.

Mumbai, June 9 : Bombay Stock Exchange (BSE) fell 3.3 per cent on Monday led lower by Reliance Industries Limited and Infosys Technologies Limited.

The BSE index fell 3.3 per cent to 15,066.10 at the close.

The BSE benchmark index, Sensex, on Monday came down by 513 points in early trade on selling in heavyweight stocks.

It stood at 15,058.98 points after a 513.20 points fall in the first five minutes of trade in line amid weakening global markets and inflationary conditions at home.

The National Stock Exchange index's Nifty stood at 4,476.65 points after shedding 141.15 points.

Market observers said that crude oil prices hovering over 139.12 dollar per barrel on Friday and the United States recording rise in unemployment rate contributed to the Monday's fall.

“We have seen that the markets have fallen today and that has happened because we've seen that the international markets overall have had weak trend on the basis of the fuel prices, the oil prices have crossed the 139 dollar per barrel price and that is going to trigger off inflation across the world as well as in India. And we have seen this sell off come by because the US markets have ended weak on Friday,” said Ganesh Shanbhag, Market Expert.

“Going forward I think the inflation is going to be a major deterrent in this country for the short term, the long-term story, the growth story remains intact, infrastructure projects are on. I am not worried about the long-term story in India. It's going to be the short term where we will see intermittent corrections and volatility. We will have to live with this volatility over here for some more time probably another two months or three months,” he added.

Elsewhere in Asia a record spike in crude prices stoking U. S. economic worries hit stock investment on Monday.

Oil remained near a record 139 dollars a barrel, sparking fears of 1970s-like stagflation after the near 40 per cent rise this year, while gold moved back above 900 dollar an ounce.

Officials of OPEC, supplier of nearly a third of the world's oil, maintained they saw no need to consider pumping more oil despite that surge.

The Nikkei was battered by that jump in oil prices and U. S. inflationary fears, with top broker Nomura tumbling.

Korean tech giant Samsung Electronics fell, pushing the KOSPI to a six-week intra-day low.

Financial markets in Hong Kong, Australia and the Philippines were closed for a public holiday. (ANI)