Mumbai: ECE Industries Ltd made its first appearance on the National Stock Exchange (NSE) at a premium of 18.67% against the offer price of Rs 589 at Rs 699.

The company has already been enrolled on the Bombay Stock Exchange (BSE) earlier, and ended at Rs 632.25 on Monday.

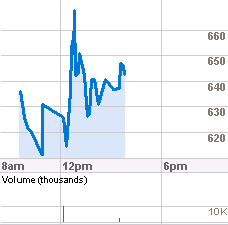

During the day, the stock touched an intraday high of Rs 728.95, an intraday low of Rs 602 and finally closed at Rs 637.85 on the NSE.