Mobile Apps Are Giving People More Ways To Try To Grow Their Finances

For as long as we know, people have always found new ways to invest their money and attempt to grow their finances. Various forms of investment will always make themselves available, and usually there are plenty of people willing to try something new, no matter how conservative or risky it might be.

For as long as we know, people have always found new ways to invest their money and attempt to grow their finances. Various forms of investment will always make themselves available, and usually there are plenty of people willing to try something new, no matter how conservative or risky it might be.

In the last few years we’ve seen a particularly drastic change in the available investment methods (and other opportunities people use similarly), thanks to the ongoing expansion of mobile app markets. From basic access to the stock market, to gaming opportunities, to brand new commodity markets, mobile apps are giving people all kinds of means by which they might be able to grow their finances. Through it all, certain options have become particularly popular.

Stock Investment Apps

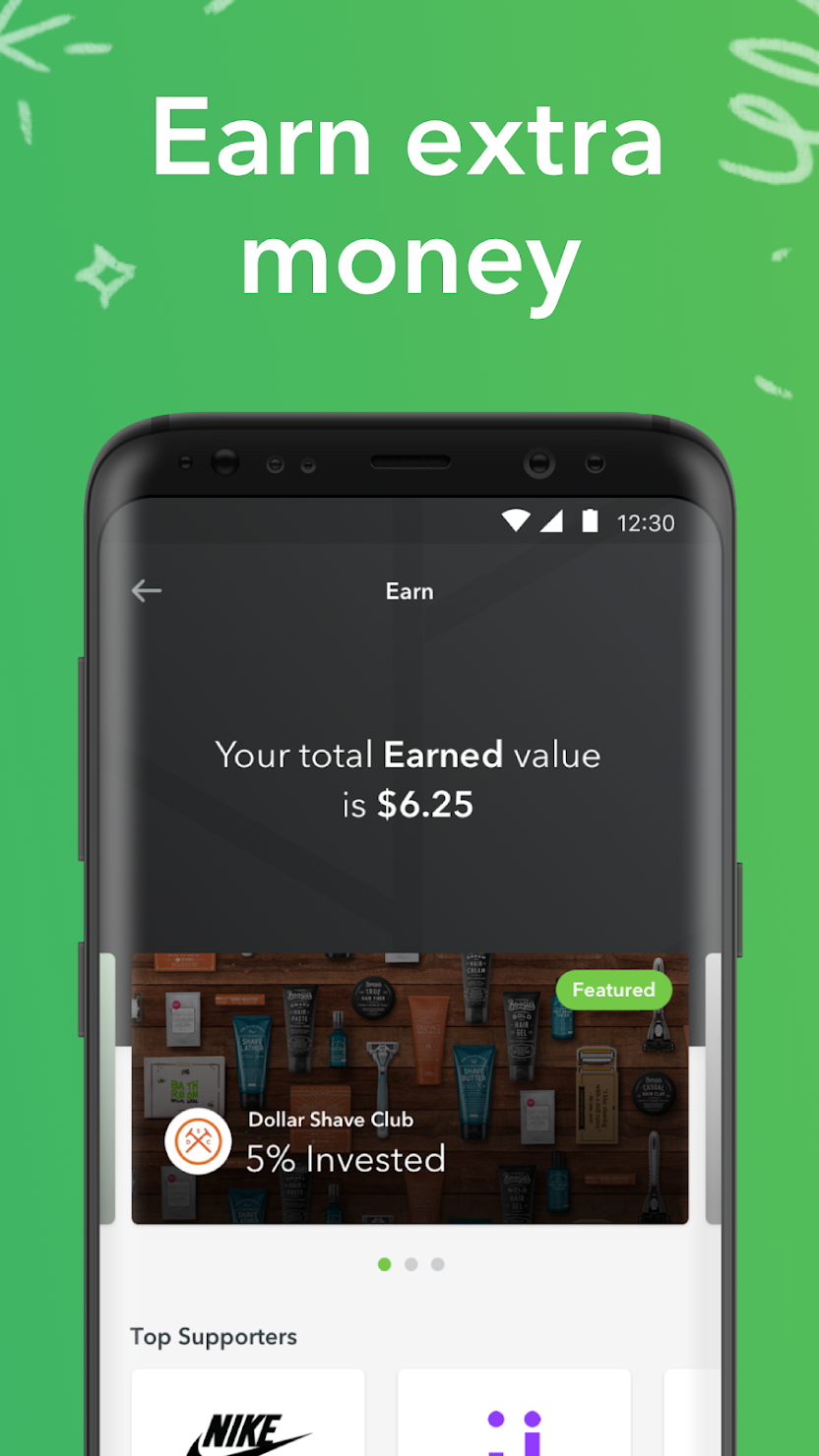

Investment apps have been around for a while now, in the sense that you can access popular trading platforms like TD Ameritrade and E-Trade via mobile programs. However, newer apps have made it into the category, such as Robinhood, Stash, and Acorns. Rather than being mobile spinoffs of existing trading platforms, these apps are designed for modern users and meant to make it easier and cheaper to invest in the stock market. They each have their differences, and there are pros and cons to them all, but the idea is that these are extremely mobile-friendly trading platforms with low fees and built-in tools to make the process more intuitive and effective.

Cryptocurrency Apps

As mentioned in the introduction, mobile apps have brought about access to brand new commodity markets, which primarily means cryptocurrencies. Essentially invented out of nowhere to function as digital, alternative currency, these cryptos have since become recognized as tradable commodities. Already there are lots of apps that allow people to use them just this way. Platforms like Coinbase and in fact even Robinhood (mentioned just above regarding stock investment apps) let you buy, hold, and sell cryptos in the hopes of making gains. These are very volatile markets, so investment is a tricky prospect. Thanks to these apps however, the actual process is fairly straightforward, and even somewhat enjoyable.

Gambling Apps

Gambling is a far cry from investment, but because it’s more and more available via mobile apps, it is something some people are using in an attempt to grow finances. It’s a fairly broad category that can refer to a few things. On the one hand, there are traditional casino gaming apps operating with real money. On the other, and perhaps slightly closer to authentic investment, there are various kinds of wagering formats surrounding sporting events. Again, these are not necessarily thought of as strategic ways to use one’s money if the hope is to earn more, but thanks to apps like William Hill, bet365 and others, mobile gambling is very popular.

Event Speculation Apps

This category is almost like a sub-genre of gambling apps, but involves some sort of fringe activities that people use as pseudo-investment without feeling like they’re betting in the traditional sense. By event speculation apps, we’re referring to things like FanDuel and PredictIt. FanDuel is one of a few “daily fantasy sports” apps, which involve real money games speculating on athletes’ performances. There are billions of dollars in this industry, and you can find plenty of discussion on how to make money taking part. PredictIt, meanwhile, is basically a simulated stock market in which shares indicate belief in a given outcome in a political debate or election. Both of these are roughly as risky as ordinary sports betting, but as with the gambling apps above, both are getting popular because of the prominence of the apps involved.

In all of these categories and through dozens of apps, you can see how people are being emboldened to try new, and sometimes exciting ways to expand their investment portfolios. Some of these ideas are wiser than others, and in any betting or investment endeavor it’s important to take a strategic approach and guard your money. But they’re all interesting nonetheless.