Trade Setup for 12 May; US-CHINA trade negotiation, India- Pakistan ceasefire and Nifty 23850 Support

The market has been reacting unpredictably to the ongoing conflict between India and Pakistan throughout the past week. As we expected, the 24,350-level acted as support, but it was eventually broken when tensions escalated and the likelihood of war between the two nations increased.

We also mentioned that 24,600 would act as a major resistance level in the upcoming trade setup, which indeed turned out to be the case, as the market saw a significant drop from that level. However, overall, the market hasn’t overreacted to the situation or shown the kind of bearish momentum that might have been expected.

Global Market Analysis

US and China to Hold Trade Talks in Geneva

The US and China are set to hold a meeting in Geneva to discuss the ongoing tariff war. This will be the first round of trade talks since President Trump announced tariffs on Chinese goods. China has also issued its response, making this the first official meeting between the world’s two largest economies on the matter.

This development appears to be a positive step. President Trump has stated that the US is taking forward-looking steps to secure a major trade deal with China and other countries. He also mentioned that the 80% tariffs on Chinese imports seem justified.

However, while these strong statements are coming from Trump, Beijing has yet to make any official announcement. This meeting is expected to be crucial, and its outcome could significantly impact the upcoming trade setup, given the scale of trade between the two nations.

Russia-Ukraine Ceasefire Talks

Recent reports indicate that Russia is ready to engage in talks with President Zelensky to end the ongoing war. This development is seen as a positive step, with Zelensky himself acknowledging it as a hopeful move toward peace. However, he also emphasized that Russia must agree to a ceasefire before any formal peace talks can begin.

Overall, this signals a promising development on a global level, reflecting potential progress in resolving the conflict between the two nations.

This could lead to positive steps toward ending the war. Former President Trump also announced on two social media platforms that he welcomes this decision, expressing hope that the ongoing bloodshed will finally come to an end. He added that this development could mark the beginning of a new and better chapter for the world.

Domestic market analysis

India-Pakistan Ceasefire

Following the intervention of the US administration, former President Trump announced that India and Pakistan have agreed to a ceasefire and decided not to escalate the conflict further. However, despite the agreement, Indian authorities reported that Pakistan violated the ceasefire shortly afterward, prompting a response from the Indian side.

While the ceasefire currently appears fragile, there has not been significant escalation beyond this point, suggesting a cautiously stable situation for now.

This development is likely to be reflected in tomorrow’s trade setup, as it is generally seen as a positive signal. However, there are also rumours suggesting that the ceasefire might have been breached by the Pakistani side, leading to a mixed sentiment among Dalal Street traders.

USD-INR Impact of the India-Pakistan Conflict

The ongoing conflict between India and Pakistan has caused significant movement in the USD-INR pair. The U.S. dollar has strengthened considerably, pushing the INR lower. USD-INR touched a low of around 84.12 during the initial phase of the conflict but then sharply rebounded to approximately 85.90.

Such a strong move was last seen in 2022 and indicates growing strength in the USD while weakening the INR. This trend is generally seen as negative for the Indian market, as rising USD-INR levels often dampen investor sentiment and increase import costs.

The impact of this movement is expected to be crucial and could be clearly reflected in Monday’s trade setup.

Trade Deal with the USA

Amid the ongoing India-Pakistan conflict, which is being mediated by the U.S. administration, reports suggest that the United States may offer India a favourable trade deal. Additionally, an Indian delegation is expected to visit Washington soon to discuss tariff-related matters.

This week, the U.S. also announced its first-ever trade deal with the U.K., with more such deals anticipated in the near future. India’s upcoming negotiations are expected to focus on reciprocal tax tariffs, potentially opening the door for broader trade cooperation.

These developments signal a significant opportunity for progress and mutual understanding. The outcome of the Indian delegation’s visit could have a major impact on market sentiment and may influence trade setups over the coming days and weeks.

FII & DII Analysis

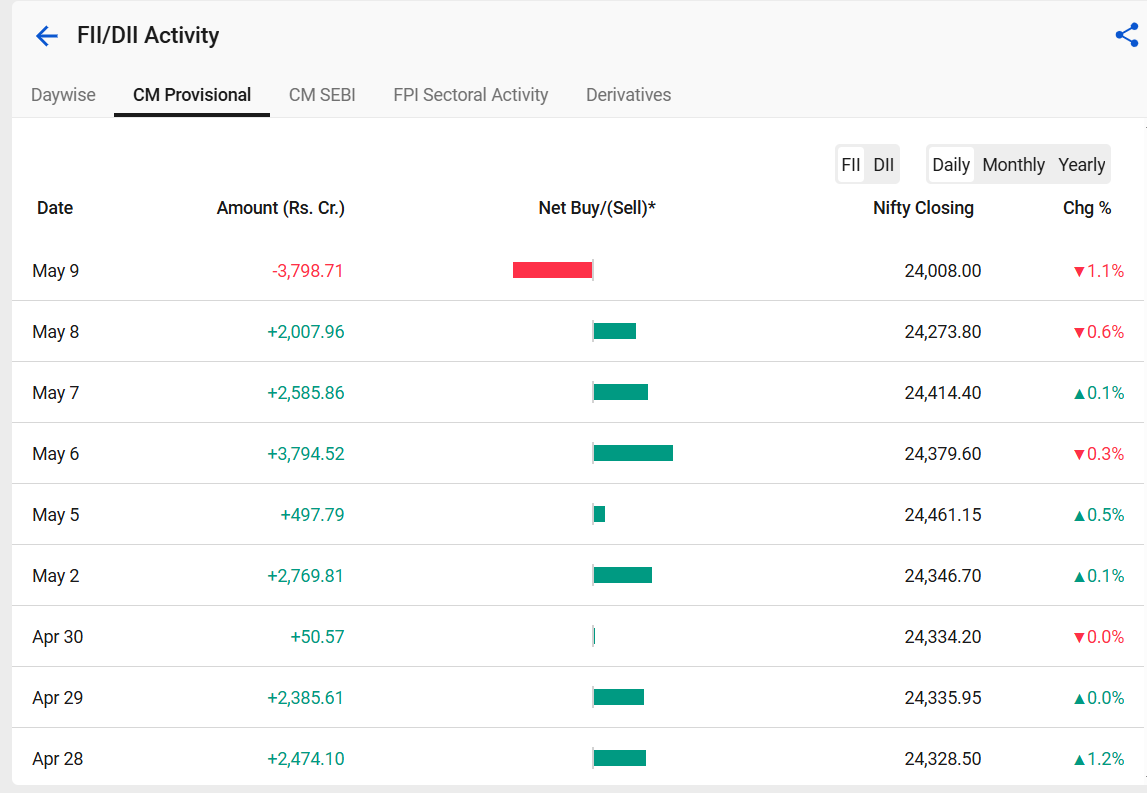

In Friday’s trade setup, Foreign Institutional Investors (FIIs) broke their steady buying trend by turning net sellers due to the ongoing conflict between India and Pakistan. Despite this, FIIs had shown consistent resilience throughout the month, remaining net buyers since April 15, with regular positive inflows. On Friday, however, FIIs still managed to end as net buyers, with an inflow of Rs. 3,798.71 crore.

Looking ahead, Monday will be a crucial session, as the market will watch closely whether FIIs continue their positive momentum in Indian equities.

Meanwhile, Domestic Institutional Investors (DIIs) have shown strong confidence, investing a massive Rs. 7,277.74 crore in Indian equities. This robust participation by DIIs is a positive sign and highlights their growing influence and support in the Indian stock market.

Nifty 50 prediction

The movement and pressure on the Nifty 50 have largely stemmed from the ongoing geopolitical conflict. However, after the intervention by the Trump administration and the resulting ceasefire agreement, the tension appears to be easing.

On a technical basis, we can observe strong support around the 23,850 level. This level has proven significant recently, as Nifty made a notable bounce back from this zone. Additionally, with a closing below the 24,000 marks, this area now stands as a key support level for the near term.

Looking at resistance, before the major 24,600 level, the 24,550 zone is likely to act as an initial resistance. This could cap the upside in the short term unless there is strong buying momentum.

Conclusion

Looking at the past two weeks, the overall market sentiment has shifted in a positive direction. The market is gaining momentum, and trade negotiations with the U.S. are progressing well, as confirmed by recent announcements from the UKGT. Although India has faced a challenging period, it is now taking positive steps—engaging in deals with both the U.S. and China, while the U.S. and China have also resumed tariff negotiations.

The Indian market had been largely stagnant over the past 8–10 months, but current developments suggest that a recovery is underway. The recent geopolitical conflict was a key hurdle; however, the announcement of a ceasefire has helped ease concerns.

FIIs have also returned as strong buyers, providing crucial support to Indian equities. While the ceasefire appears fragile and there is still a chance of renewed tension, the market is likely to interpret India’s strong defense posture positively. This could enhance confidence among foreign investors.

Overall, the market looks stable and optimistic for now. As long as there is no further escalation, the outlook remains favorable, and we can expect a mild bullish trend in the days ahead.