Commodity Outlook for Crude oil by Kedia Commodity

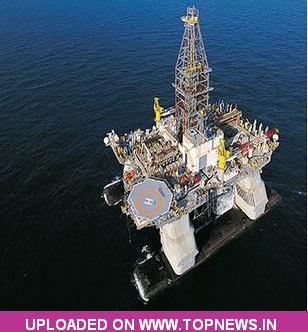

Crude oil rose posting the highest close in two years on a stronger-than-expected rise in U. S. jobs. Global oil demand next year could bounce back to levels last seen in 2007 as recovery from the deepest recession in decades drives fuel use, but the Organization of the Petroleum Exporting Countries (OPEC) does not plan to add extra capacity as more non-OPEC supply curbs the need. China's top refineries will process a record high volume of crude oil in November after Beijing hiked fuel prices, as domestic fuel stocks were running low and diesel shortages were spreading in some regions. Now support for the crude is seen at 3832 and below could see a test of 3818. Resistance is now likely to be seen at 3854, a move above could see prices testing 3862.

Crude oil rose posting the highest close in two years on a stronger-than-expected rise in U. S. jobs. Global oil demand next year could bounce back to levels last seen in 2007 as recovery from the deepest recession in decades drives fuel use, but the Organization of the Petroleum Exporting Countries (OPEC) does not plan to add extra capacity as more non-OPEC supply curbs the need. China's top refineries will process a record high volume of crude oil in November after Beijing hiked fuel prices, as domestic fuel stocks were running low and diesel shortages were spreading in some regions. Now support for the crude is seen at 3832 and below could see a test of 3818. Resistance is now likely to be seen at 3854, a move above could see prices testing 3862.

Trading Ideas:

Crude trading range is 3818-3862.

Crude oil rose on a stronger-than-expected rise in U. S. jobs

Crude looks to test support at 3818 and resistance is seen at 3868.

Global oil demand next year could bounce back to levels last seen in 2007 – OPEC