Commodity Trading Tips for Nickel by KediaCommodity

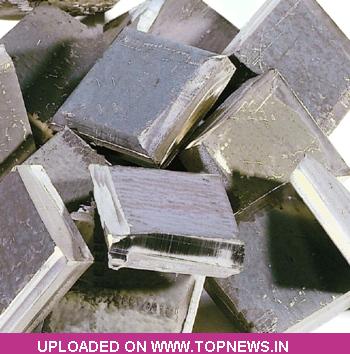

Nickel settled 1.1% up at 833.90, the worst performing LME metal this year, were capped by news that Indonesia expects the first stage of a $1-billion nickel pig iron smelter in Central Sulawesi to start operations by the end of 2014. Prices received an additional boost from a weaker US dollar, as dollar-priced commodities become less expensive to investors holding other currencies when the greenback falls. Italy’s Treasury sold EUR3 billion worth of ten-year debt at an average yield of 3.94%, the lowest since October 2010 and down from 4.66% at a similar auction last month. Rome also sold EUR3 billion of five-year government bonds at an average yield of 2.84%, also the lowest since October 2010 and down from 3.65% at a similar auction last month. Market sentiment found support after a new government was sworn in Italy, ending months of political deadlock after inconclusive elections in February. Meanwhile, the US dollar was broadly lower against the other major currencies, as Friday’s weaker than expected US Q1 growth data reinforced expectations for continued easing by the Fed. The Commerce Department said US GDP expanded by 2.5% in the three months to March, missing expectations for growth of 3.0%. Market players will be focusing on Wednesday’s policy statement from the US central bank, for further hints regarding the future of the central bank’s monetary easing program. Investors will also be awaiting the outcome of the ECB’s policy meeting, amid growing expectations for a rate cut, as well as Friday’s closely watched report on US nonfarm payrolls. For today's session market is looking to take support at 824.0, a break below could see a test of 814.1 and where as resistance is now likely to be seen at 839.8, a move above could see prices testing 845.7.

Nickel settled 1.1% up at 833.90, the worst performing LME metal this year, were capped by news that Indonesia expects the first stage of a $1-billion nickel pig iron smelter in Central Sulawesi to start operations by the end of 2014. Prices received an additional boost from a weaker US dollar, as dollar-priced commodities become less expensive to investors holding other currencies when the greenback falls. Italy’s Treasury sold EUR3 billion worth of ten-year debt at an average yield of 3.94%, the lowest since October 2010 and down from 4.66% at a similar auction last month. Rome also sold EUR3 billion of five-year government bonds at an average yield of 2.84%, also the lowest since October 2010 and down from 3.65% at a similar auction last month. Market sentiment found support after a new government was sworn in Italy, ending months of political deadlock after inconclusive elections in February. Meanwhile, the US dollar was broadly lower against the other major currencies, as Friday’s weaker than expected US Q1 growth data reinforced expectations for continued easing by the Fed. The Commerce Department said US GDP expanded by 2.5% in the three months to March, missing expectations for growth of 3.0%. Market players will be focusing on Wednesday’s policy statement from the US central bank, for further hints regarding the future of the central bank’s monetary easing program. Investors will also be awaiting the outcome of the ECB’s policy meeting, amid growing expectations for a rate cut, as well as Friday’s closely watched report on US nonfarm payrolls. For today's session market is looking to take support at 824.0, a break below could see a test of 814.1 and where as resistance is now likely to be seen at 839.8, a move above could see prices testing 845.7.

Trading Ideas:

Nickel trading range for the day is 814.17-846.

Nickel settled, worst performing LME metal this year, were capped by news that Indonesia expects the first stage of a $1-billion nickel pig iron

Market sentiment found support after new government was sworn in Italy, ending months of political deadlock after inconclusive elections

Market players will be focusing policy statement from US, for further hints regarding the future of central bank’s monetary easing program.