USD/INR Update by KediaCommodity

USD/INR dropped following reports that the Indian government is in talks with the JPMorgan Chase and Co. and others to gain entry to benchmark indices for emerging market debt and may ease some restrictions on foreign purchases of rupee-denominated debt in hope of attracting more dollar inflows to the country.

USD/INR dropped following reports that the Indian government is in talks with the JPMorgan Chase and Co. and others to gain entry to benchmark indices for emerging market debt and may ease some restrictions on foreign purchases of rupee-denominated debt in hope of attracting more dollar inflows to the country.

The RBI sold $3.2 billion in the forex spot market, and bought $724 million in August, the central bank's bulletin showed. In the month ago period, the central bank had sold $6 billion in the forex spot market, and bought $50 million.

India likely saw little respite from high inflation levels in September as prices of food and imports continued to climb despite a relief rally in the battered rupee.

Indeed, the consensus would make it the fourth consecutive month of wholesale prices above the RBI's perceived comfort level of 5 percent.

Last month, RBI governor Raghuram Rajan surprised markets with a 25 basis points hike and clearly signalled that the central bank's focus would be bringing down inflation.

Although the rupee gained 5 percent last month, it is not expected to recover much more ground in the near term and remain weak, according to a poll, making the cost of crude oil imports more expensive.

The rupee's recent gain came after a more than four months of decline, with the currency losing as much as 20 percent at one stage and hitting a series of record lows.

Reserve Bank of India (RBI) Governor Raghuram Rajan, who took office last month when worst economic crisis since 1991 hit India but Reserve Bank of India and the US Federal Reserve both played a vital role in the rupee's appreciation. The RBI helped the rupee recover from its losses from 67.73 to 63.38 while the Federal Reserve supported the rupee from 63.38 to 61.77. Thereafter, the rupee again slipped due to fading optimism over the Fed's decision on the QE and the RBI's measures to arrest the currency's slides. When the rupee touched the historical high of 68.8450 against the dollar, the RBI provided a Forex swap window to the Oil Marketing Companies (OMC) to meet the monthly dollar requirement for payment.

Under this process, the RBI sold US dollars and bought the rupee to Oil Marketing Companies for a fixed tenor with an intention to help the companies for their monthly requirement of $8 to $8.5 billion. This slowed down the month-end dollar demand and shored up the rupee.

Thereafter, the Indian government along with the Japanese government has decided to expand their currency swap arrangement (exchange rupee and yen at a certain price and maturity) from $15 billion to $50 billion to tackle its Balance of Payment problem and retain dollar reserves during the bilateral trades. This step was taken to protect the country from a future financial shortfall. This has supported the rupee's recouping of its losses against the dollar. The Federal Reserve's statement on continuing its MBS (Mortgage backed security) and treasury buying program has created optimism in the global market, especially in the emerging nations. The Indian economy also absorbed this positivism. This surprise move by the Fed provided room to the RBI in enact its interest rate decision. The main focus of the RBI was to normalize the economic conditions, increase investment activity and improve the industrial and manufacturing production by controlling inflation. The RBI increased the repo rate by 25basis points from 7.25% to 7.50% and consequently reduced the Marginal Standing Facility rate and Bank rate by 75bps from 10.25% to 9.50% in order to adjust the 200bps difference between the repo rate and these two rates (MSF & bank rate). It however impacted inversely on the rupee and domestic indices. The Sensex lost more than 500 points and the rupee depreciated more than a percent in one single day due to tight liquidity conditions.

Furthermore, the RBI's measures to inject approximately Rs 1.5 trillion through the Liquidity Adjustment Facility (LAF), Export Credit Refinance Facility (ECRF) and the Marginal Standing Facility (MSF) to the productive sectors aimed at easing the liquidity crunch in the Indian financial system supported gains in the rupee. On the whole in September, the rupee surged around 5% and posted its biggest monthly gains against the dollar, since September 2012. The rupee traded in the 68.62-61.65 range and settled at 62.49, after recovering 10.16% from the month's low of 68.62 in response to the dollar.

The Federal Reserve Chief decision to continue with $85 billion monthly bond purchase until the economy reaches an inflation level of 2.5% and unemployment of 6.5%. The decision was a green signal to global investors and supported global equities and currencies, especially in the emerging nations to revive from their losses.

The Reserve Bank of India's measures:

Forex Reserves:

India's Foreign exchange reserves showed recovery in the month of September ($277.382 billion), after touching a three-year low of $274 billion. The forex reserves improved after the RBI took measures such as relaxing the norms for non-resident Indian (NRI) deposits and overseas borrowings by banks. The Reserve Bank of India (RBI) freed interest rates on the FCNR (Foreign Currency Non-Resident bank account) deposits. Consequently, the RBI allowed

banks to offer 400bps over the London interbank offered rate (LIBOR) for deposits with maturities between 3 to 5 years. The RBI also offered a forex swap facility at 3.5%, which is less than the prevailing market rate for maturities above 3 years. Through this process, the RBI received around $5 billion from overseas banks and about $8-10Bn is expected to come through as foreign currency from non-resident deposits. The improving foreign exchange reserves may support the rupee to further appreciate against the dollar.

Trade Balance

India's trade deficit has been narrowing in the last few months. In September, it improved by 11% to -$10.917 billion from -$12.268 billion in August. The RBI and Government of India continued measures to curb gold and crude oil imports, supporting a recovery in the trade balance. The improving trade deficit in the second quarter of FY2013-14 may make import bills cheaper and reduce government spending. However, the coming festive season may support the purchase of more gold. The Indian government's intention to curb gold imports by taking every possible action could weigh down on local demand.

Trade Balance

India's trade deficit has been narrowing in the last few months. In September, it improved by 11% to -$10.917 billion from -$12.268 billion in August. The RBI and Government of India continued measures to curb gold and crude oil imports, supporting a recovery in the trade balance. The improving trade deficit in the second quarter of FY2013-14 may make import bills cheaper and reduce government spending. However, the coming festive season may support the purchase of more gold. The Indian government's intention to curb gold imports by taking every possible action could weigh down on local demand.

Industrial Production and Inflation rate

India's HSBC Purchasing Managers Index (PMI) manufacturing number has declined to 48.5 in August, the lowest level after March 2009, led by a decline in new orders, especially export orders. The slowdown in manufacturing activities may weigh down on the industrial production which is due in October, and could affect market sentiments. However, the inflation is expected to slow due to declining food and fuel prices and the RBI measures, including the hike in the interest rate.

The India and US 10 Year Bond Yield

India's 10 year bond yield has slightly stabilized in the month of September after touching a record high level of 9.24% but, the level is still higher than the levels in August. The US' bond yield declined in September in comparison to August. Therefore, the spread difference has narrowed from 0.32 to 0.29. The Indian bond yield is higher in comparison to the US' bond yield, indicating more demand for US bonds. India's bond prices declined due to the liquidity crunch in the market, along with lower investment activities at the domestic front. This may limit gains in the rupee in near term.

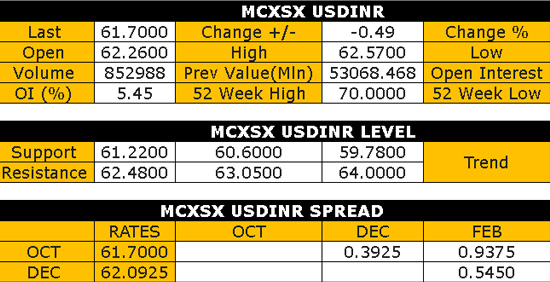

OUTLOOK: SELL USDINR ON JUMP TILL 62.20-62.50 SL 63.50 TGT 60.80-59.60.