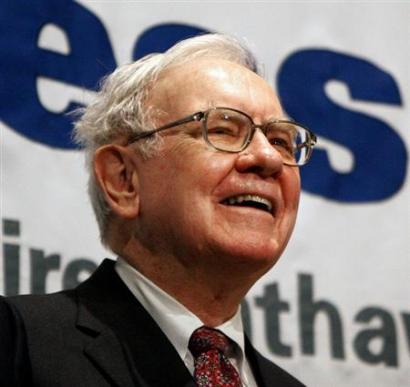

Berkshire Hathaway reports better profit

Warren Buffett's Berkshire Hathaway reported that its book value has risen $21.8 billion in 2009, a record for the company. The previous record was $16.9 billion, achieved in 2006.

Warren Buffett's Berkshire Hathaway reported that its book value has risen $21.8 billion in 2009, a record for the company. The previous record was $16.9 billion, achieved in 2006.

However, between these two periods of high growth, the company faced its worst year ever in history when the book value fell by $11.5 billion in 2008. That was only the second decline in Warren Buffett's 45-year history of running Berkshire Hathaway.

Though the company's per-share book value rose by 19.8% in 2009, that came close to the long-term compounded annual rate of return of 20.3% level as it has been under Buffett's leadership.

Per-share book value is Buffett's customary way of reporting shareholder results, as Berkshire believes that the aforementioned method takes into account all capital losses and gains whether realized or not. In fact, analysts believe that increase in the stock value was the main reason that the company's book value climbed sharply in 2009.

The share price of the stock has registered a whopping 70% rise which today trade at a level of $1,20,000 as compared to the price of $70,000 in the month of March 2009.