NSE Nifty Support at 24,400, Indian Export to USA Rises and Russian Crude Remains Major Issue with US-Trade Deal

The market is experiencing pressure from the upside as the deadline for the tariffs has been announced. August is the final month for the current administration to support the tariffs. India now faces a 25% tariff on exports to the USA, which was expected based on earlier discussions and analysis. In Friday’s trade setup, the market saw a drawdown of nearly 200 points and also closed near the day’s low, which indicates some seriousness in the weakening strength. However, some reports suggest that the impact of the tariffs on Indian exporters will be minimal. That remains a key point. Additionally, important discussions are taking place in Washington, so let’s see how things work out. The market is surely going to react to these developments.

News Analysis

25% Tariffs on India

The USA has imposed 25% tariffs on India, which was largely expected by analysts, as estimates ranged from 20% to 25%. The deal has not been finalized due to concerns related to the agriculture and dairy industries.

At the same time, India has suffered a significant setback, especially in sectors like textiles, as peer markets such as Vietnam and Bangladesh are facing relatively lower tariffs — around 20% for Bangladesh and 19–20% for Vietnam. In comparison, India's 25% tariff puts its exporters at a disadvantage.

Pakistan has received a 19% tariff, which is also important in the context of agricultural exports.

These developments are crucial, and concerns are rising about the long-term implications of these tariffs. There may be serious consequences, including cost-cutting measures and potential job losses in India’s export industry.

Nasdaq Falls from High

In Friday’s trade setup, the Nasdaq fell by more than 450 points, marking a drop of around 2%. This decline is driven by concerns over tariffs and the short-term pain anticipated for the U.S. economy, as predicted by analysts. The tariffs are expected to be applied after August 7th, and how things unfold from there remains a critical point of uncertainty.

In the short term, there is likely to be an inflation hike, which could impact the U.S. economy. At the same time, a key concern is how manufacturing in the U.S. will respond. This becomes even more important in light of the recent jobs data, which was notably weak—only 73,000 jobs were added in July. If such macroeconomic indicators continue to show weakness, it could lead to serious negative consequences.

In the short term, an inflation hike is expected, which could negatively impact the U.S. economy. At the same time, a major concern is how manufacturing activity in the U.S. will respond. This issue has become more critical following the release of disappointing job data—only 73,000 jobs were added in July. This figure is significantly lower than expected. If macroeconomic indicators like this continue to weaken, it could lead to serious consequences for the economy.

India's iPhone Exports to the USA Rise in Q1

Recent data from the March–June quarter shows that India’s iPhone exports to the USA surged to nearly $6 billion — an all-time high — despite ongoing pressure from Washington. Reports suggest that the U.S. has warned Apple that if iPhones manufactured in India are sold in the U.S., they may face tariffs. However, even in the face of such warnings, Apple has continued iPhone production in India and remains focused on future export growth to the U.S.

These developments are providing a significant boost to India’s manufacturing sector and strengthening trade ties between the two economies.

India Continues to Buy Russian Oil

India continues to purchase Russian crude oil, as it is offered at a cheaper price compared to global crude benchmarks. This reflects the strength and sovereignty of India’s foreign policy, showing that the country is not dependent on any particular nation when making strategic decisions.

These actions also signal India’s willingness to resist pressure from the U.S. administration. As trade negotiations progress, the outcomes remain uncertain, but these developments are sure to have a significant impact in the coming months.

FII and DII Data Analysis

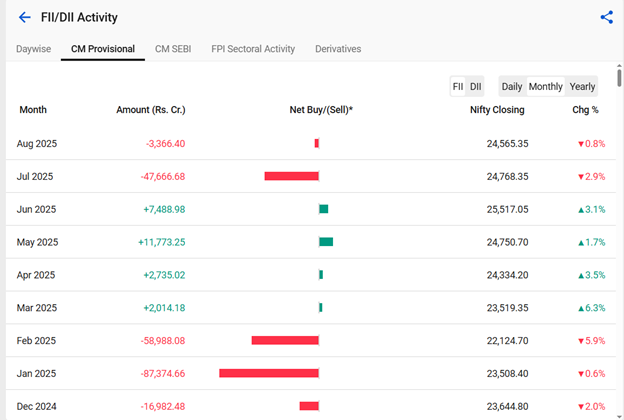

Foreign Institutional Investors (FIIs) and Domestic Institutional Investors (DIIs) have played a key role in the recent market movements. In July, the Nifty saw a significant decline of nearly 1,000 points, largely attributed to heavy selling by FIIs, who offloaded around ₹47,000 crore worth of Indian equities. This marked one of the major sell-offs in recent months.

On the other hand, DIIs stepped in strongly, purchasing nearly ₹60,000 crore during the same month. Despite their support, the market still ended in negative territory for July, breaking a four-month upward trend.

Notably, FIIs were net buyers from March to June, but July witnessed a clear reversal with heavy selling. These shifts are crucial, especially as the outcome of trade negotiations between India and the U.S. remains uncertain. How India manages these negotiations will have a significant impact on investor sentiment going forward.

Nifty Fifty Technical Analysis

Amid pressure from FIIs and the August 1st deadline set by the U.S. administration, the market witnessed a sharp decline of nearly 1,000 points from the recent highs. However, several reports suggest that the impact of the tariffs on India is expected to be minimal, with no major long-term effects anticipated.

Following this correction, the market appears to have stabilized. A key short-term support level is seen at 24,440, which is considered a strong technical level. On the upside, resistance is likely around 25,000, which will be a crucial level to watch in the coming sessions.

The outcome of trade negotiations will also play a vital role in determining whether the market can sustain or break through these levels.

Conclusion

The market is giving off signals of concern, largely due to the 25% tariff imposed on India — one of the highest among Asian countries. This move could give a competitive edge to peers like Bangladesh, Pakistan, and Vietnam.

However, there is some support visible around the 24,440 level, which is considered a strong technical zone. Additionally, reports suggest that the actual impact of the tariffs may be minimal. India is also expected to reach a conclusion on trade negotiations soon, which could help stabilize sentiment and guide the market’s next move.