Trade Setup for 10 June: NSE Nifty eyes 25200 level, CHINA-US scheduled to meet for Trade Discussions

The market has been continuing its previous momentum following the RBI's actions, gaining further strength and maintaining upward movement. According to the overall analysis, the 25,200 level appeared to be a strong resistance, and that is exactly what played out in both the market and individual stocks—they respected the 25,200 level as resistance, with the market making a high of 25,160 today. This level is becoming a key point of consideration, as the market is still closing above the 25,000 marks. Today, it closed around 25,103.

Global Market Analysis

China export falls to US

Chinese exports are slowing down significantly due to the ongoing tariff war with the USA. The impact of U.S. tariffs is becoming more evident, as Chinese export growth fell to a three-month low in May. This slowdown highlights the substantial effect of trade tensions on China’s export performance.

The data shows that China’s exports to the U.S. have declined by nearly 34% on a year-on-year basis. This drop is primarily due to the U.S. imposing a 30% tariff on Chinese imports, while exports from the U.S. to China face only a 10% tariff. This imbalance is a very significant factor affecting trade between the two countries. It marks the sharpest decline since February 2020, when the COVID-19 outbreak impacted the global economy.

If trade negotiations regarding tariffs do not take place between the two countries, it is likely that the current situation will remain unchanged. Additionally, the trade deficit between them is expected to be affected. This ongoing issue is likely to put pressure on China to come to the negotiating table and reach a deal.

US and China talk on trade deal

The U.S. and China are scheduled to meet in London on June 9th for the first round of talks regarding a potential trade deal between the two global economies. This is a significant step, especially considering the previous escalation of tariffs by both countries.

Recently, they agreed to a 90-day pause and initiated a negotiation to reduce tariffs—currently, U.S. imports from China are subject to a 30% tariff, while U.S. exports to China face a 10% tariff. This round of negotiation is crucial for making progress toward a comprehensive trade agreement.

The outcome of this meeting will be a key factor to watch, as it will depend on the statements released by both countries and how the negotiations unfold. These are the crucial questions for the coming days and will significantly influence the upcoming trade setup.

Domestic Market Analysis

Piyush Goyal visit to Switzerland and Sweden

India’s Commerce Minister, Piyush Goyal, is scheduled to visit Switzerland and Sweden to discuss a potential Free Trade Agreement (FTA) with these countries. This marks a very significant step, as India continues to strengthen its economic ties and engage in meaningful international trade discussions. These talks are especially important as negotiations with the European Union regarding a broader FTA are also ongoing.

Countries like Switzerland and Sweden have strong expertise in machine tools and advanced manufacturing, along with a reputation for precision engineering. This has been acknowledged by Piyush Goyal, who has stated that India is taking further steps to establish trade deals with these nations.

U.S. Trade Team Extends India Visit

The U.S. trade delegation, originally scheduled to hold talks in India on June 5–6, has now decided to extend its stay. This indicates potential progress in the discussions, which could be beneficial for both countries. Earlier, U.S. commerce Secretary Howard lutnick had stated that India is not too far from reaching a trade deal with the U.S. If the outcome of these talks is positive, it is likely to have a significant impact on the market.

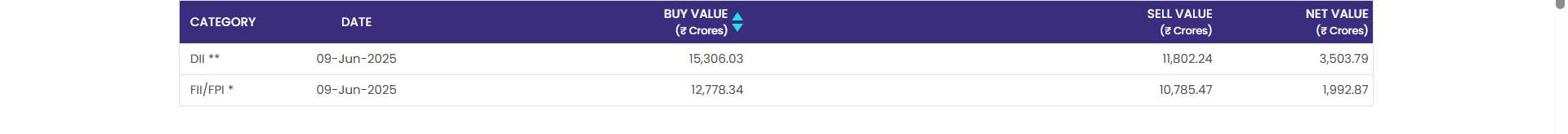

FII and DII Data Analysis

Buying by the FII is continuing, as they have purchased nearly 2000 crore rupees in the 2-day state setup, while the DI has also contributed 3503 crore rupees in the same period. So, both the FII and DI have become net buyers according to the FII setup.

This is what is driving the NIFTY to its highest levels. If the buying by FII and DI remains sustainable, we can expect a strong short-term high around the 25,200 level, and we may possibly close above that level. For this to happen, both institutions need to remain positive.

Nifty 50 Technical Analysis outlook

The 25,100 level is expected to be crossed in today’s data setup. Currently, the exact technical resistance level is 25,116, which is the key resistance. If we consider a slightly higher number, 25,200 will act as a strong resistance for now. Today’s gap opening, sustaining that gap, gaining 100 points, and closing above 25,103—which is higher than the 25,100 level—is a very positive sign.

Now, the next trading session will be crucial, as we are likely to test either yesterday’s candle high at 25,029 or the 25,200 level.

Conclusion

Sustainable buying from the FIIs and the positive commentary from last week by the RV are supporting the sustainability of the Nifty 50, and we are likely to see significant progress. If the sustainable buying from the FIIs continues, it will be more than enough to drive the Nifty 50 even higher.

These are the key factors to watch, along with the outcomes from the G7 and President Trump’s recent meetings, which will also be important for the IT sector and could play a role in pushing the Nifty 50 higher.

Further Reading

US Trade team extend stay in India for extended discussions - https://www.bloomberg.com/news/articles/2025-06-08/us-trade-team-said-to-extend-india-stay-as-talks-gather-momentum

Chinese export growth falters - https://www.reuters.com/world/china/chinas-may-exports-slow-deflation-deepens-tariffs-bite-2025-06-09/