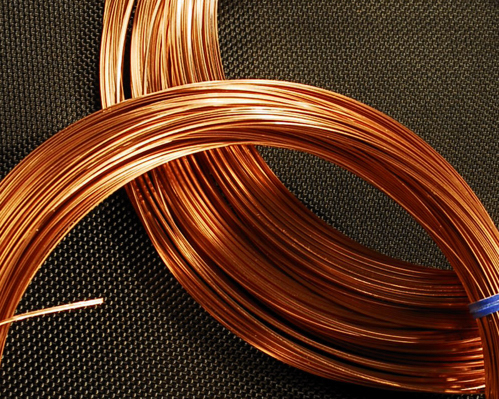

Base Metals floated higher with the equities markets and mostly ended higher than their previous close. Three month LME Copper rose by $150 to end at $4470 and the three month LME Nickel rose by $475 to finish the day at $1150.

Base Metals floated higher with the equities markets and mostly ended higher than their previous close. Three month LME Copper rose by $150 to end at $4470 and the three month LME Nickel rose by $475 to finish the day at $1150.

Copper futures edged higher on Fridaytracking a fall in LME inventories. Copper stocks on the LME fell by 10,925 tonnes to 429,500 tonnes. Some traders are of the view that China's State Reserves Bureau (SRB), which bought 350,000 tonnes of copper cathode in the first quarter of 2009, could sell around 50,000 tonnes of copper to cash in on recent rallies.