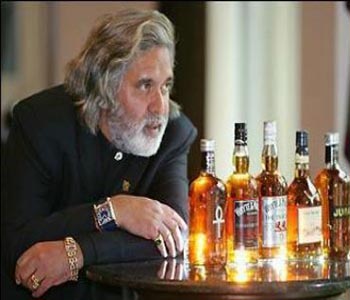

Mallya's $2.1bn deal with Diageo changes lenders’ mood from gloom to hope

Liquor tycoon Vijay Mallya's $2.1 billion deal to sell a stake in United Spirits to Diageo Plc has changed the mood of lenders from absolute gloom to some hope, throwing a lifeline to grounded Kingfisher Airlines.

Liquor tycoon Vijay Mallya's $2.1 billion deal to sell a stake in United Spirits to Diageo Plc has changed the mood of lenders from absolute gloom to some hope, throwing a lifeline to grounded Kingfisher Airlines.

Though proceeds from the stake sale will not be sufficient to rescue the grounded carrier, yet it is expected to allow Mallya to make a piecemeal payment to Kingfisher lenders and get them back at the negotiating table for new loans.

Speaking on the condition of anonymity, a senior investment banker at a Mumbai branch of a European bank, "Kingfisher is a liquidity issue and if he is able to inject some liquidity that will get banks to open the lines again, he will definitely do that.”

According to the State Bank of India (SBI), the leader of a seventeen-bank consortium that has lent nearly $1.4 billion to Kingfisher Airlines, the ailing carrier requires to raise at least $1 billion by the end of November.

Meanwhile, Kingfisher Airlines has confirmed that it has started paying salaries to its employees. The debt-laden carrier had not been paying salaries to its employees for around seven months. Employees with low salaries (below Rs 20,000) received their May salary on last Friday.

Civil aviation regulator DGCA had suspended Kingfisher Airlines' flying licence on October 19 following a lockout, and the carrier’s failure to come up with a feasible plan to revive the carrier.