Commodity Trading Tips for Crude Oil by KediaCommodity

Crude oil futures trimmed gains and settled at 4875 that up by 0.35% easing off a six-day high after government data showed that US crude supplies rose for the 3rd week, while investors remained wary in the absence of a breakthrough on a second bailout deal for Greece. The US EIA said in its weekly report that crude oil inventories rose by 0.3mbls, below expectations for a 2.5mbl increase. US crude supplies rose by 4.2mbls in the preceding week. Total crude oil inventories stood at 339.2mbls as of last week, remaining in the upper limit of the average range for this time of year. The govt report came after the API, an industry group that US crude inventories fell by 4.5mbls last week. Meanwhile, investors continued to eye developments surrounding talks on a debt restructuring deal for Greece. Investors remained wary in the absence of any signs of a breakthrough in Greece but risk appetite remained supported by underlying expectations that a deal to pave the way for a default-saving bailout was getting closer. Iranian lawmakers are pushing a plan to halt crude exports. Now technically market is trading in the range as RSI for 18days is currently indicating 38.61, where as 50DMA is at 5136 and crude is trading below the same and getting support at 4842 and below could see a test of 4810 level, And resistance is now likely to be seen at 4920, a move above could see prices testing 4966.

Crude oil futures trimmed gains and settled at 4875 that up by 0.35% easing off a six-day high after government data showed that US crude supplies rose for the 3rd week, while investors remained wary in the absence of a breakthrough on a second bailout deal for Greece. The US EIA said in its weekly report that crude oil inventories rose by 0.3mbls, below expectations for a 2.5mbl increase. US crude supplies rose by 4.2mbls in the preceding week. Total crude oil inventories stood at 339.2mbls as of last week, remaining in the upper limit of the average range for this time of year. The govt report came after the API, an industry group that US crude inventories fell by 4.5mbls last week. Meanwhile, investors continued to eye developments surrounding talks on a debt restructuring deal for Greece. Investors remained wary in the absence of any signs of a breakthrough in Greece but risk appetite remained supported by underlying expectations that a deal to pave the way for a default-saving bailout was getting closer. Iranian lawmakers are pushing a plan to halt crude exports. Now technically market is trading in the range as RSI for 18days is currently indicating 38.61, where as 50DMA is at 5136 and crude is trading below the same and getting support at 4842 and below could see a test of 4810 level, And resistance is now likely to be seen at 4920, a move above could see prices testing 4966.

Trading Ideas:

Crude trading range for the day is 4810-4966.

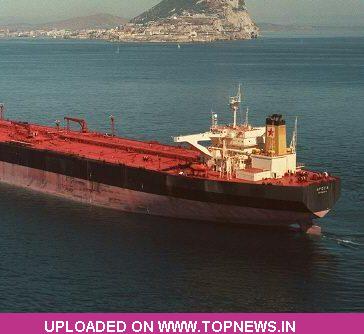

Crude oil trimmed gains after government data showed that crude supplies roses.

Oil traders were also monitoring tensions between Iran and the West.

Brent prices have outperformed crude in recent sessions amid concerns over a disruption to supplies from African.