HDFC hopes revision of key interest rates by RBI

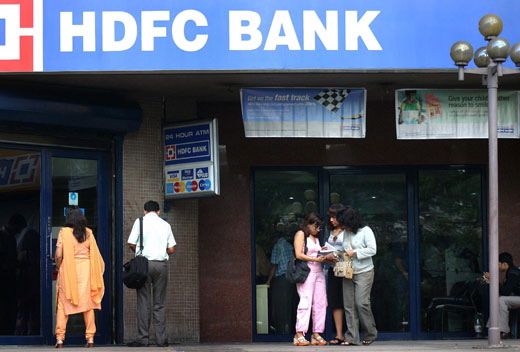

Deepak Parekh, chairman of Housing Development Finance Corporation (HDFC), said that his bank can cut interest rate in case the Reserve Bank takes steps to reduce lending rates in the market, making the fund cost cheaper for banks.

Deepak Parekh, chairman of Housing Development Finance Corporation (HDFC), said that his bank can cut interest rate in case the Reserve Bank takes steps to reduce lending rates in the market, making the fund cost cheaper for banks.

Hoping reduction in key interest rates, Mr. Parekh said, "Banks are funding (parking) Rs 40,000 crore to Rs 60,000 crore with RBI under the reverse repo window. (This means) there is enough liquidity in the system and that is why there is a likelihood of interest rates coming down."

He said that inflation rate had fallen to one-year low of 4.38%, below the comfort zone of 5 per cent set by the apex bank. It paves a way to revise interest rate by RBI to propel the growth rate of country, projected 7.1 per cent in the interim budget for the current financial year by government.

Meanwhile, HDFC bank termed the decision of SBI to freeze home loan interest rates at 8 per cent for a year as a "gimmick". Mr. Parekh said, "SBI is not trying to get any new money or loans in the housing finance market but is only trying to get existing customers."