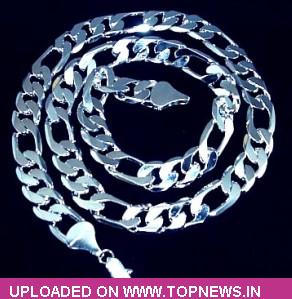

Commodity Trading Tips for Silver by KediaCommodity

Silver price traded in the range on Saturday and closed flat down at 64284 despite of rally in international as the Federal Reserve's decision a day earlier to launch a third round of quantitative easing boosted the appeal of the precious metal. On MCX prices where under pressure as rupee posted its biggest gain in two-and-a-half months after the government's diesel price hike raised hopes for more fiscal reforms, while the Federal Reserve's stimulus action sparked a rally in global risk assets. Overall bullion look firm as FOMC also said it would likely keep the federal funds rate near zero through at least the middle of 2015. The prior guidance on the first rate increase had been late 2014. The precious metal has rallied on past monetary stimulus measures. Investors tend to flock to gold on fears that excess liquidity would erode the value of fiat currencies and spark inflation. The QE3 announcement sparked a sell-off in the greenback, which further boosted the appeal of the precious metal. Gold futures are traded in US dollars and become cheaper for investors who use other currencies when the greenback weakens. Now technically market is trading in the range as RSI for 18days is currently indicating 73.01, where as 50DMA is at 57995 and silver is trading above the same and getting support at 64190 and below could see a test of 64096 level, And resistance is now likely to be seen at 64373, a move above could see prices testing 64462.

Silver price traded in the range on Saturday and closed flat down at 64284 despite of rally in international as the Federal Reserve's decision a day earlier to launch a third round of quantitative easing boosted the appeal of the precious metal. On MCX prices where under pressure as rupee posted its biggest gain in two-and-a-half months after the government's diesel price hike raised hopes for more fiscal reforms, while the Federal Reserve's stimulus action sparked a rally in global risk assets. Overall bullion look firm as FOMC also said it would likely keep the federal funds rate near zero through at least the middle of 2015. The prior guidance on the first rate increase had been late 2014. The precious metal has rallied on past monetary stimulus measures. Investors tend to flock to gold on fears that excess liquidity would erode the value of fiat currencies and spark inflation. The QE3 announcement sparked a sell-off in the greenback, which further boosted the appeal of the precious metal. Gold futures are traded in US dollars and become cheaper for investors who use other currencies when the greenback weakens. Now technically market is trading in the range as RSI for 18days is currently indicating 73.01, where as 50DMA is at 57995 and silver is trading above the same and getting support at 64190 and below could see a test of 64096 level, And resistance is now likely to be seen at 64373, a move above could see prices testing 64462.

Trading Ideas:

Silver trading range for the day is 64096-64462.

Silver closed flat despite of rally in international as FED's decision a day earlier to launch Q3 boosted sentiments

There was news out of the euro zone that the ECB and IMF negotiated to use EUR 300 billion as Spain's rescue fund

FED will inject a total of USD85 billion a month into the economy a month via its combined stimulus measures.