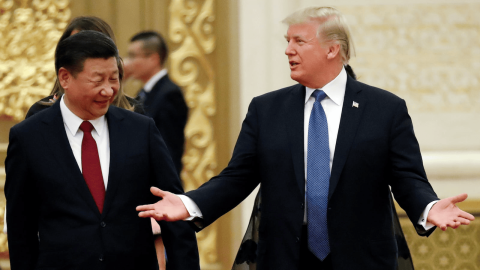

Trump Confident of US-China Trade Deal Soon

In a move that could significantly reshape global trade dynamics, US President Donald Trump has expressed confidence that a US-China tariff deal may be finalized within the next three to four weeks. While the rhetoric signals optimism from Washington, the underlying tensions between the world’s two largest economies remain complex. Trump’s comments, delivered with characteristic bravado, blend the dual messages of confidence and strategic patience. As both nations continue to levy steep tariffs on each other’s goods, financial markets remain on edge, and businesses await tangible evidence of progress in what could be one of the defining trade negotiations of the decade.

Trump Signals Confidence in Near-Term Trade Agreement

President Donald Trump stated that the United States and China are edging closer to a trade pact, with negotiations gaining momentum. In recent remarks, Trump shared that senior Chinese officials have reached out “a number of times,” and described the ongoing dialogue as “very good.” He floated a possible timeline of “three to four weeks” for a resolution, though he refrained from detailing specific breakthroughs or confirming direct communication with President Xi Jinping.

Trump’s messaging, while optimistic, continues to carry an element of strategic ambiguity—a hallmark of his negotiating style aimed at preserving leverage.

Tariffs: Still a Weapon, Still a Wedge

Despite projecting optimism, Trump maintains that he is “in no rush” to ink a deal. He reiterated that U.S. tariffs are “making the country rich,” framing them as a powerful negotiating instrument. The administration’s recent move to raise tariffs on Chinese imports to 145%, and China’s retaliation with 125% tariffs on U.S. goods, underscores that both sides are still entrenched in a high-stakes standoff.

While Trump has signaled a possible pause or rollback in tariffs should negotiations progress, the threat of economic escalation remains a potent bargaining chip. This dual narrative—projecting confidence while sustaining pressure—has become a signature element of Trump’s trade doctrine.

China’s Position: Dialogue With Conditions

Chinese officials have acknowledged willingness to negotiate, but with clear stipulations. Beijing has emphasized that talks must be based on “mutual respect, equality, and benefit.” Officials have also cautioned the U.S. against using tariffs and coercion as tools for extracting concessions. While both sides appear willing to talk, the fundamental gap in negotiating philosophy—transactional pragmatism from Washington versus principle-based diplomacy from Beijing—remains a challenge to rapid consensus.

China's approach suggests that any potential agreement must satisfy broader strategic and nationalistic concerns, not just economic pragmatism.

Markets React to Uncertainty and Strategic Messaging

Trump’s tariff strategy has been met with skepticism from U.S. business leaders and market participants. Major indices have witnessed episodic volatility in response to policy pronouncements. Critics warn that prolonged trade tensions could raise input costs, depress corporate margins, and ultimately reduce U.S. competitiveness.

However, Trump has countered these concerns by asserting that his administration’s firm stance has invited trade overtures from over 75 countries, indicating global interest in new trade alignments. Whether this leads to meaningful deals or remains political theater is still up for debate.

Summary Table: Trump’s US-China Tariff Outlook

| Aspect | Trump’s Position/Statements | Current Status/Actions |

|---|---|---|

| Deal Timeline | “Next three to four weeks” | Ongoing negotiations, no formal agreement |

| Tariff Levels | 145% on Chinese imports | China imposed 125% in response |

| Negotiation Tone | Confident, “very good talks” | No direct confirmation of Xi communication |

| Leverage Narrative | “No rush,” tariffs are wealth-generating | Strategic delay, sustained pressure tactics |

| Market Impact | Dismisses business community concerns | Market volatility and caution persist |

| China’s Stance | Open to dialogue with conditions | Demands mutual respect and halt to pressure |

Geopolitical Undercurrents and Broader Implications

Beyond the economic dimensions, the U.S.-China negotiations are layered with geopolitical complexity. As allies such as the European Union and ASEAN nations calibrate their trade and diplomatic alignments, the outcome of this bilateral conflict will reverberate globally. Trump’s recent comment that he’s unconcerned about allies “getting closer to China” reflects his administration’s transactional worldview—a stark contrast to multilateralism.

This perspective adds unpredictability to U.S. foreign relations, as other nations may hedge their bets in anticipation of future policy shifts, especially with upcoming U.S. elections looming.

Investor Takeaway: Strategic Patience Required

While Trump’s projection of a swift resolution is encouraging, investors should remain cautious. The lack of concrete updates, the continued imposition of record-high tariffs, and China’s insistence on parity in discussions suggest that the deal is far from guaranteed. For financial markets and corporate planners, this is a time for strategic hedging, scenario modeling, and close monitoring of policy developments.

In the event of a breakthrough, export-sensitive sectors and tariff-hit supply chains could rally sharply. On the flip side, continued deadlock could escalate into a broader trade war with global consequences.

Conclusion: Bold Promises, Uncertain Path

President Donald Trump’s assertion that a U.S.-China trade deal could be achieved within a month represents the latest chapter in a saga that has oscillated between hope and hostility. While the confidence from Washington is notable, the reality remains that both sides are still navigating a fraught and highly complex negotiation. With tariffs now soaring and national pride entrenched on both sides, only time will tell whether diplomacy can outpace confrontation.

Until then, investors, markets, and policymakers must brace for turbulence—and stay tuned for what could be a historic turning point in global trade.