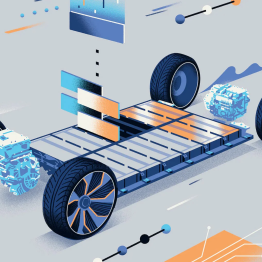

Building on its monumental success in 2023, Chinese electric vehicle (EV) manufacturer BYD anticipates a significant jump in domestic as well as international plug-in car sales for the current year

News in Focus

Following its resounding success in its home market, BYD is now gearing up to make significant strides in its global expansion journey.

In the dynamic realm of electric vehicle (EV) production, American electric car pioneer Tesla Motors encountered a notable challenge in first quarter (Q1) of 2024 as the gap between its production

In the ever-evolving electric vehicle (EV) sector, the second-hand market witnessed a noteworthy development in the second fiscal quarter of 2024 – a persistent decline in prices.

Ford Motor Company has unleashed its latest offering in the electric vehicle (EV) market: the 2024 Ford Mustang Mach-E, a battery-electric compact crossover SUV that is now available for online ord

In the ever-evolving landscape of European FinTech and banking, 2024 is poised to witness a resurgence in mergers and acquisitions (M&A) activity, driven by compelling market dynamics outlined

Main Regional Stories

President Biden's recent conversation with Israeli Prime Minister Benjamin Netanyahu has sparked significant attention, with revelations that the U.S. administration will not endorse any retaliatory measures by Israel against Iran.

The National Aeronautics & Space Administration (NASA) lunar vehicle development team may use General Motors’ (GM’s) cutting-edge Ultium EV technology for its Artemis campaign, which aims to send astronauts back to the Moon by 2026.

Lucid Group Incorporated, an American manufacturer of luxury electric vehicles (EVs) headquartered in the Newark area of California, hit a significant milestone in the first quarter (Q1) of 2024, as it achieved a new record for electric car delive

In the ever-evolving landscape of the cryptocurrency market, a confluence of factors is poised to test its resilience, with the imminent U.S.

In a revised study on trends in the global tech industry, technology research and advisory firm Gartner stated that the European sovereign debt crisis and a feebler euro will impact global IT spending during the existing year (2010).

In a revised study on trends in the global tech industry, technology research and advisory firm Gartner stated that the European sovereign debt crisis and a feebler euro will impact global IT spending during the existing year (2010).  The 30-share index Sensex today increased up by 51.75 points to 17,561.08 during the opening trade, regaining overnight losses, on the back of fresh demand from stockists.

The 30-share index Sensex today increased up by 51.75 points to 17,561.08 during the opening trade, regaining overnight losses, on the back of fresh demand from stockists. Pepper July delivery gained Rs 141 and settled at Rs 18040/quintal boosted by export demand amid limited domestic supplies. Pepper prices will stabilize with positive bias. Pepper exports fell 22 percent to 19,750 tonnes in April-March period, but traders say shipments have been picking up. Spot pepper gained168 rupees to end at 17,892 rupees per 100 kg in Kochi. The contract touched the intraday high of Rs 18138/quintal while low of Rs 17852/quintal. Now support for the pepper is seen at 17882 and below could see a test of 17724. Resistance is now likely to be seen at 18168, a move above could see prices testing 18296.

Pepper July delivery gained Rs 141 and settled at Rs 18040/quintal boosted by export demand amid limited domestic supplies. Pepper prices will stabilize with positive bias. Pepper exports fell 22 percent to 19,750 tonnes in April-March period, but traders say shipments have been picking up. Spot pepper gained168 rupees to end at 17,892 rupees per 100 kg in Kochi. The contract touched the intraday high of Rs 18138/quintal while low of Rs 17852/quintal. Now support for the pepper is seen at 17882 and below could see a test of 17724. Resistance is now likely to be seen at 18168, a move above could see prices testing 18296. Guar yesterday we have seen that market has moved -1.23% on poor demand in the physical market and hop

Guar yesterday we have seen that market has moved -1.23% on poor demand in the physical market and hop Talks between Brazilian miner Vale SA and the United Steelworkers union to end an 11-month-old strike at Vale's nickel operations in Ontario have been terminated, as the two sides were deadlocked. Nickel has touched a low of Rs 895 a kg after opening at Rs.917, and last traded at Rs 902.9.For today market is looking for the support at 892.9, a break below could see a test of 883 and where as resistance is now likely to be seen at 914.9, a move above could see prices testing 927.

Talks between Brazilian miner Vale SA and the United Steelworkers union to end an 11-month-old strike at Vale's nickel operations in Ontario have been terminated, as the two sides were deadlocked. Nickel has touched a low of Rs 895 a kg after opening at Rs.917, and last traded at Rs 902.9.For today market is looking for the support at 892.9, a break below could see a test of 883 and where as resistance is now likely to be seen at 914.9, a move above could see prices testing 927. Japan's refined zinc exports for May fell 39 percent from a year earlier to 8,717 tonnes, with Taiwan accounting for the largest share of export volume, Ministry of Finance data showed. Zinc yesterday we have seen that market has moved -1.16%. Market has opened at 82.7 & made a low of 81.55 versus the day high of 82.85. The total volume for the day was at 22174 lots and the open interest was at 7755.Now support for the zinc is seen at 81.5 and below could see a test of 80.9. Resistance is now likely to be seen at 82.8, a move above could see prices testing 83.5.

Japan's refined zinc exports for May fell 39 percent from a year earlier to 8,717 tonnes, with Taiwan accounting for the largest share of export volume, Ministry of Finance data showed. Zinc yesterday we have seen that market has moved -1.16%. Market has opened at 82.7 & made a low of 81.55 versus the day high of 82.85. The total volume for the day was at 22174 lots and the open interest was at 7755.Now support for the zinc is seen at 81.5 and below could see a test of 80.9. Resistance is now likely to be seen at 82.8, a move above could see prices testing 83.5.