Building on its monumental success in 2023, Chinese electric vehicle (EV) manufacturer BYD anticipates a significant jump in domestic as well as international plug-in car sales for the current year

News in Focus

Following its resounding success in its home market, BYD is now gearing up to make significant strides in its global expansion journey.

In the dynamic realm of electric vehicle (EV) production, American electric car pioneer Tesla Motors encountered a notable challenge in first quarter (Q1) of 2024 as the gap between its production

In the ever-evolving electric vehicle (EV) sector, the second-hand market witnessed a noteworthy development in the second fiscal quarter of 2024 – a persistent decline in prices.

Ford Motor Company has unleashed its latest offering in the electric vehicle (EV) market: the 2024 Ford Mustang Mach-E, a battery-electric compact crossover SUV that is now available for online ord

In the ever-evolving landscape of European FinTech and banking, 2024 is poised to witness a resurgence in mergers and acquisitions (M&A) activity, driven by compelling market dynamics outlined

Main Regional Stories

President Biden's recent conversation with Israeli Prime Minister Benjamin Netanyahu has sparked significant attention, with revelations that the U.S. administration will not endorse any retaliatory measures by Israel against Iran.

The National Aeronautics & Space Administration (NASA) lunar vehicle development team may use General Motors’ (GM’s) cutting-edge Ultium EV technology for its Artemis campaign, which aims to send astronauts back to the Moon by 2026.

Lucid Group Incorporated, an American manufacturer of luxury electric vehicles (EVs) headquartered in the Newark area of California, hit a significant milestone in the first quarter (Q1) of 2024, as it achieved a new record for electric car delive

In the ever-evolving landscape of the cryptocurrency market, a confluence of factors is poised to test its resilience, with the imminent U.S.

The Taiwanese based maker of netbooks, Asus is developing a new notebook that utilizes a smartphone as a 3G dongle for connectivity. It seems that the Taiwanese maker is making headlines all way along as this netbook restricts the user to make use of specific range of models which are supposedly be lacking in features and may end up being priced uncompetitively, claims the manufacturer.

The Taiwanese based maker of netbooks, Asus is developing a new notebook that utilizes a smartphone as a 3G dongle for connectivity. It seems that the Taiwanese maker is making headlines all way along as this netbook restricts the user to make use of specific range of models which are supposedly be lacking in features and may end up being priced uncompetitively, claims the manufacturer. Google came up with its latest proclamation, hinting the release of its Google Voice application for students. The declaration that was made whilst the launch, claimed that users will be registered with the .edu domain, that, Google will send to interested students and allow them to join the services of the same, as taken from the Google Voice Blog.

Google came up with its latest proclamation, hinting the release of its Google Voice application for students. The declaration that was made whilst the launch, claimed that users will be registered with the .edu domain, that, Google will send to interested students and allow them to join the services of the same, as taken from the Google Voice Blog.  Facebook has proclaimed that it wants to simplify the security settings, following the circulating controversies that take care of the users' privacy. The Vice-President of Facebook, Eliot Schrage stated that the company is putting in efforts to protect the privacy data and make the settings simpler for users to access, as reported to The Financial Times.

Facebook has proclaimed that it wants to simplify the security settings, following the circulating controversies that take care of the users' privacy. The Vice-President of Facebook, Eliot Schrage stated that the company is putting in efforts to protect the privacy data and make the settings simpler for users to access, as reported to The Financial Times.  Google has fallen under the scanner from the European privacy regulators for its Street View project. This axing was enforced when Google disclosed that since 2006, it had been collecting private data about wireless networks which was required for the photo database for the Street View project.

Google has fallen under the scanner from the European privacy regulators for its Street View project. This axing was enforced when Google disclosed that since 2006, it had been collecting private data about wireless networks which was required for the photo database for the Street View project.  Taiwanese manufacturer HTC has given out its new offering -HTC Wildfire. Wildfire is a lookalike of HTC Desire, difference being its appearance which is stockier and smaller. The Wildfire sports 81mm screen that has 320 x 240 pixels. It is powered by 528MHz Qualcomm processor- MSM ranged, WiFi, GPS, HSDPA, Android 2.1 with HTC's Sense UI.

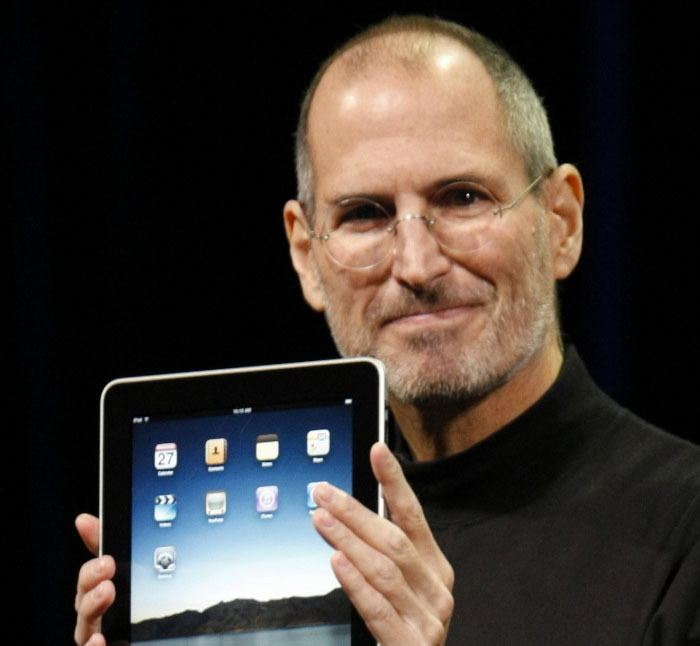

Taiwanese manufacturer HTC has given out its new offering -HTC Wildfire. Wildfire is a lookalike of HTC Desire, difference being its appearance which is stockier and smaller. The Wildfire sports 81mm screen that has 320 x 240 pixels. It is powered by 528MHz Qualcomm processor- MSM ranged, WiFi, GPS, HSDPA, Android 2.1 with HTC's Sense UI.  CEO of one the most reputed firms, Apple, Steve Jobs has recently vented out his dismay due to iPad through an e-mail.

CEO of one the most reputed firms, Apple, Steve Jobs has recently vented out his dismay due to iPad through an e-mail.