Renowned venture capitalist Vinod Khosla has forecasted a revolutionary shift in robotics akin to the transformative impact of ChatGPT in natural language processing.

News in Focus

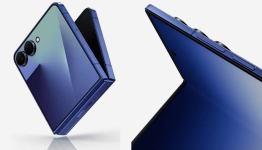

Samsung is set to redefine the foldable smartphone landscape with the debut of its latest innovation, the Galaxy Z Fold 7, scheduled for unveiling at the upcoming Galaxy Unpacked event on July 9 in

In a groundbreaking moment for Indian cinema, Bollywood superstar Deepika Padukone has been selected for the prestigious Hollywood Walk of Fame, marking her as the first Indian actress to achieve t

Divi's Labs and Glenmark shares jumped to 52-week highs and the stocks closed near their highs. On technical charts, both the stocks are looking strong.

Laurus Labs, Asahi India Glass, and Poonawalla Fincorp shares were among winners this week. Laurus Labs touched 52-week high at Rs 777.9 and the stock closed at Rs 777.7 (almost at its highs).

Suzlon Energy share price managed to close the week above Rs 65.

Main Regional Stories

BP Equities has issued a BUY recommendation on Lemon Tree Hotels Limited, India’s largest mid-priced hotel chain, setting a target price of Rs 172 per share, representing a 24% upside from the current market price of Rs 138.

Motilal Oswal Financial Services has issued a resounding BUY recommendation on JSW Infrastructure, setting a target price of Rs 370 per share, representing a potential upside of 20% from current levels.

Evoplay, the Kyiv-based studio known for merging video-game aesthetics with real-money play, has secured its first foothold in the Peruvian lottery arena through a content pact with Loterías Torito.

In a bid to deepen its foothold in the mythology-themed slots genre, Pragmatic Play has unveiled Waves of Poseidon, a visually immersive 6x5 slot game that takes players on a volatile oceanic journey under the rule of the sea god himself.

gained ground after declaring it got an approval to make and sell Amlodipine Besylate in the United States. Its share price bobbed up 1.82% to Rs 358.25.

gained ground after declaring it got an approval to make and sell Amlodipine Besylate in the United States. Its share price bobbed up 1.82% to Rs 358.25. has topped the gainers list on Bombay Stock Exchange (BSE).

has topped the gainers list on Bombay Stock Exchange (BSE). IFCI topped the volume charts on BSE with 89.56 lakh shares.

IFCI topped the volume charts on BSE with 89.56 lakh shares.